Financial Planning Articles:

October is Cyber Security Month! In the digital age, Cybersecurity has become just as important as portfolio diversification or retirement planning. Cyber threats are constantly evolving, and individuals—not just corporations—are frequent targets. As your trusted advisor we believe it is prudent to review cybersecurity best practices and provide an update on new threats to help keep your accounts and personal data secure.

Financial fraud doesn’t always begin with stolen credit cards. Hackers often attempt to access bank accounts, investment accounts, and even tax records. While institutions, corporations, and government entities spend billions of dollars on cyber security hardware and software, the most vulnerable entry point often comes down to an individual’s personal device(s) and online practices.

Earlier this month, on July 4th, President Trump signed into law the ‘One Big Beautiful Bill’. The largest bill of its kind since the TCJA bill in 2017, this will have sweeping impacts on many government areas including immigration, federal budgetary restrictions, Medicaid, and personal income taxes.

This has been a hotly contested bill, and both sides of the aisle have argued strongly for and against some of these changes. We aim to avoid any political bias but felt it was important to discuss the key impacts this bill will have, specifically on personal finances and taxes.

With many of the changes to this bill, the answer to how this could impact you is, as always….’it depends’.

Simply put, your taxes are based on all sources of income and capital gains received throughout the year. Your income is taxed at a tiered marginal rate then your capital gains are taxed at a fixed rate based on your total income.

Employee Stock Ownership Plan (ESOP) is a common way small and midsized companies compensate their employees. ESOP owned companies have a long track record of being employee centric, lower rates of layoffs, and fewer corporate changes.

That being said, employee-owned companies can be purchased by external buyers (competitors, private equity firms, etc.). Check out this article to discover some possible outcomes.

‘Super Catch-Up’ contributions will allow workers who turn 60-63 during the year to contribute even more beyond the normal Catch-Up contribution. This additional $3,750 is a welcome addition for many pre-retirees. Read the full blog for all the details!

This might be the most common retirement planning question we get — and one of the most impactful. There are many variables to consider but the most important, and maybe the simplest to understand, is your expected longevity. At its core, Social Security is a supplemental income to help support living during retirement. The monthly benefit continues to grow 8% per year until age 70 where it hits its maximum and then continues for the rest of your life.

On April 16, 2024 the IRS released Notice 2024-35, providing updated guidance on the “10 - year rule” that outlines how Required Minimum Distributions (RMD) must be taken from inherited IRA/401k/403b/etc. If you’ve been wondering how this guidance may impact you or your heirs, this article will help.

Practical tips on how to navigate a received inheritance; what to do first, how to manage the hierarchy of saving, and how to simplify the process to get everything in order.

If you’re not familiar with the term RMD, the Internal Revenue Code requires owners of retirement accounts to begin taking money out of these accounts every year once reaching age 73, this is known as a required minimum distribution (RMD). Since these accounts have benefited from tax-deferred growth. this is Uncle Sam’s way of getting his share.

Social Security can be claimed as early as 62 or as late as age 70. Upon reaching full retirement age, you are eligible to receive the basic benefit amount. However, the timing of when you file will determine if you receive more or less than the basic benefit amount.

There are a number of financial points to consider (and documents to update) when you’re a new or expecting parent. This checklist provides a simple guide on key things to update (ex. beneficiaries) and organize during this exciting stage of life.

Investment Philosophy Articles:

Everyone's talking about AI. You hear about companies like NVIDIA, Microsoft, or Google leading the charge, and their stock prices have certainly reflected the excitement. But what if you're looking for those hidden opportunities, the "picks and shovels" that support the gold miners?

The largest ‘Hyperscalers’ in this space are projected to spend over $500 billion in 2026 alone and well north of $1 Trillion (yes with a T) by 2030. So where is all of this money actually going? The AI revolution isn't just about fancy software or super-smart algorithms. It’s also creating a massive demand for the less glamorous, often overlooked infrastructure that makes AI possible.

It's easy to feel comfortable with risk when the market is consistently climbing. Everyone can feel like an "aggressive investor" during a bull run. However, the true test of your risk tolerance comes when the market experiences turbulence. Did the dips trigger anxiety? Did you find yourself constantly checking your portfolio? Or did you view these fluctuations as potential buying opportunities, maintaining a long-term perspective?

Read this blog to learn more about risk tolerance.

Excerpt from Westview article from January 2025:

The Federal Reserve (or the Fed), the central bank of the United States, plays a pivotal role in shaping the nation’s economy. These rates influence everything from consumer loans and mortgages to business investments and the health of the overall economy.

Before the creation of the Fed in 1913, the U.S. economy was marked by frequent financial panics and a lack of central authority to stabilize the monetary system.

Every weekday evening you are likely to hear on the radio or TV about how the Dow Jones Industrial Average (The Dow), and the S&P 500 did that day in the markets. The S&P 500 and the Dow Jones Industrial Average are two widely recognized benchmarks used to gauge the performance of the stock market in the United States. While both indexes provide insights into the overall health of the market, there are some key differences between them.

This article is an attempt to discuss the topic of dividends from the perspective of the individual investor and his or her financial advisor. Its four sections are not meant to be comprehensive. Rather, it aims to be educational and to discuss the merits (and demerits) of owning dividend paying stocks relative to what is often cited as their alternative – bonds and “growth stocks.”

Berkshire Hathaway Chairman and CEO Warren Buffet famously writes an Annual Shareholder letter each year. In this article we’ll explore one of Buffet’s recent musings on investment management as gardening. What can we learn from his investment management as gardening metaphor? In the paragraphs that follow we attempt to answer this question. Our answer is not exhaustive, but we hope it sheds light on the investment process at Westview.

A number of years ago I read Richard Thaler and Cass Sunstein’s book, Nudge: Improving Decisions About Health, Wealth, and Happiness. The book, first published in 2009, argues that individuals often make poor, sub-optimal decisions due to cognitive and behavioral biases.

Treasury Inflation Protected Securities (or TIPS) are bonds that are issued by the U.S. Treasury and specifically designed to protect against rising inflation. Find out how they work in this article from Ben Nostrand, CFP.

Posted in April 2023, this article helps make sense of the Silicon Valley Bank failure and other turmoil in regional banking at that time.

Volatility is normal - don’t let it derail your long-term investment plans. Did you know that the best trading days often happen within a month after the worst trading days? Check out this article and graphs to learn more.

Time, diversification, and the volatility of returns. In the financial industry these are considered ‘The Big Three’. Learn how these factors at play impact financial planning and strategies in this article originally posted in May 2022.

Market Talk Articles:

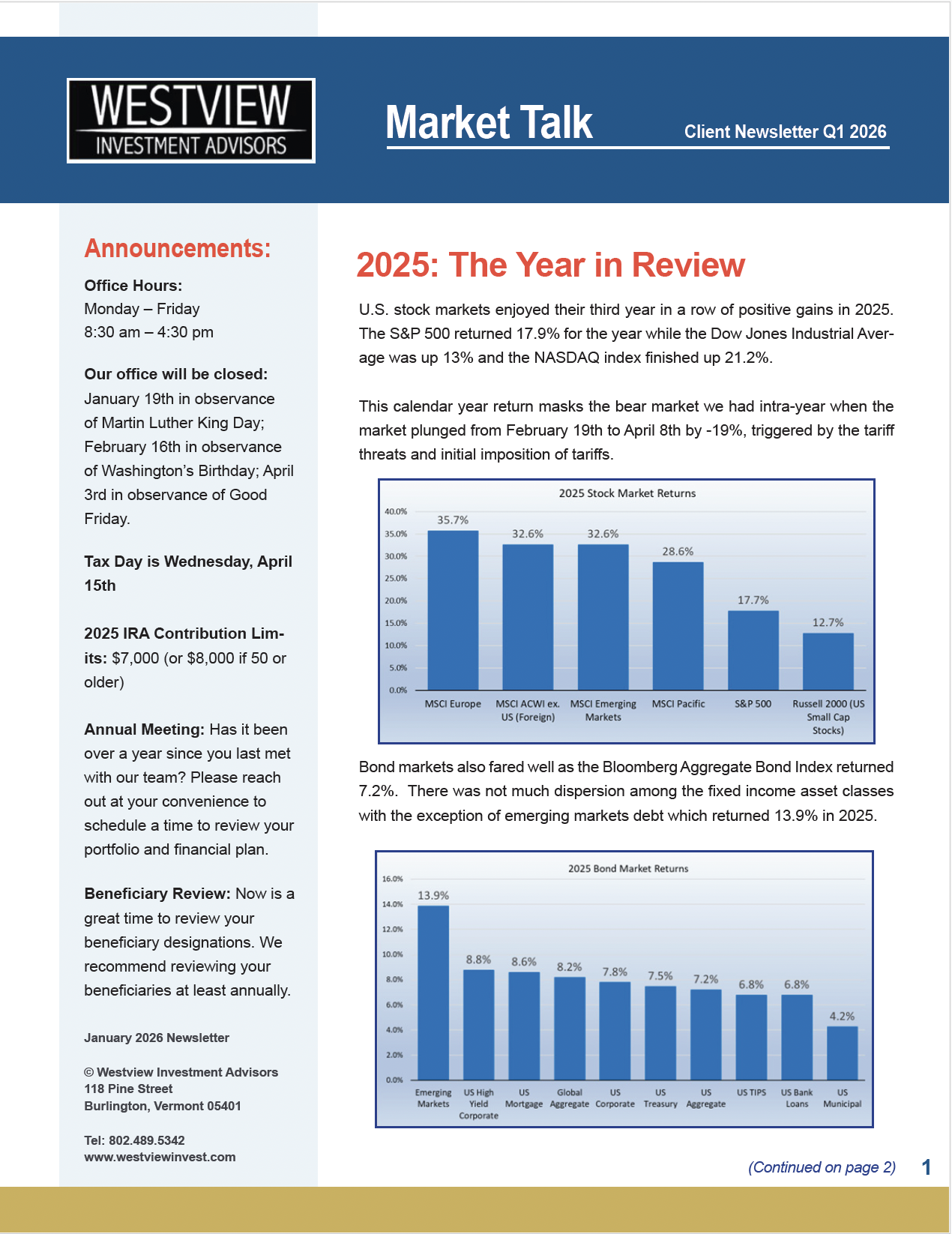

U.S. stock markets enjoyed their third year in a row of positive gains in 2025. The S&P 500 returned 17.9% for the year while the Dow Jones Industrial Average was up 13% and the NASDAQ index finished up 21.2%.

This calendar year return masks the bear market we had intra-year when the market plunged from February 19th to April 8th by -19%, triggered by the tariff threats and initial imposition of tariffs.

Excerpt from Westview article written in October 2025:

This note is for anyone who's been told, maybe not infrequently, that they need to look on the bright side. This year has been a test for those of us that have viewed the market’s resilience with some healthy skepticism. On a net basis, stocks have moved higher in the face of aggressive tariff policy, stubborn inflation, and a job market that is showing some signs of weakening. Investment in AI and continued growth of chipmakers have powered stocks, and their valuations, to new heights. The AI juggernaut, Nvidia, has reached not just industry-leading but market-leading size, illustrating how the fate of the two are more intertwined than ever. Still, despite this concentration risk and the S&P 500 already being up 14% through the first 9 months of the year (about 70th percentile of returns through 3Q), we see a set up for the market to end the year on solid footing.

Excerpt from Westview article written in April 2025:

U.S. stocks have had a tumultuous year so far, driven by concerns over tariffs leading to slower growth, higher inflation, and greater accumulation of national debt. Peak to trough (February 19th to April 8th), the market dropped nearly 20%. Despite these issues remaining unresolved, and the addition of a rise in Middle East tensions, the market rallied 24% from its lows on April 8th and is now up 5.5% on the year. In our estimation, this is a fairly classic example of stocks climbing a “wall of worry,” which is to say that investors trade positive news updates that help to rule out a worst-case-scenario.

Excerpt from Westview article from January 2025:

For the second year in a row, the stock market was up significantly in 2024. The S&P500 ended the year up 25%, the Dow was up 15% and the NASDAQ was up 27%. Notable drivers in the stock market were technology up 35.7%, communication services (includes Facebook, Alphabet), consumer discretionary 29.1%, and financials up 28.4%.

Excerpt from a Westview article written on April 7, 2025:

Is this another Trump negotiation tactic? How will nations react and enter negotiations? Will businesses move manufacturing back to the US (which takes years) or will they wait and see? These are all questions that will be watched closely.

Third quarter 2023 recap: Equities took a much-needed breather during the 3rd Quarter of 2023. The S&P 500 was down -3.3% during the period but as the chart illustrates, remains up +13.1% for the year-to-date period.

Second quarter 2023 recap: Equities continued to climb in Q2 2023. The Nasdaq was the standout yet again, up +12.8% in the 2nd Quarter (+32% YTD). Shares of the S&P 500 gained +8.3% (+16.9% YTD) and the Dow Jones Industrial Average rose +3.4% (+4.9% YTD).

Total Returns for Q1 2024: Dow +5.62%, S&P +10.16%, Nasdaq +9.11%, Russell 2000 +4.81%

Investors dialed back their expectations for rate cuts during the first quarter of 2024 and now expect the Federal Reserve to lower interest rates only three (as op posed to six) times this year.

2022 Review: The most challenging year for investors since the financial crisis came to an end last week. The large cap S&P 500 index finished down -18.1%. The tech-heavy NASDAQ plummeted 33% as more than 50% of the names in that index declined 50% or more. The Dow Jones Industrial Average dropped 8% as the value orient- ed names in that index of 30 stocks fared much better.

2023 - the year no one saw coming. Uncertainty around inflation, interest rates, and a possible recession was the dominant theme in the stock and bond markets in 2023. The Fed wound down its two-year inflation fighting campaign of interest rate increases this fall as inflation continued its down- ward retreat, all while the economy continued to grow. This resulted in significant gains for the stock market and modest gains for the bond markets in 2023 after an atrocious 2022.

Second quarter 2024: U.S. stock markets continued their ascent in the latest quarter with the S&P 500 now up 15.3% year to date. The tech heavy NASDAQ was up 18.1%, while the Dow was up only 4.8%. Small cap stocks were up only 1.7% as they continued their decade long underperformance.

All Articles:

2025: The Year in Review

U.S. stock markets enjoyed their third year in a row of positive gains in 2025. The S&P 500 returned 17.9% for the year while the Dow Jones Industrial Average was up 13% and the NASDAQ index finished up 21.2%.

This calendar year return masks the bear market we had intra-year when the market plunged from February 19th to April 8th by -19%, triggered by the tariff threats and initial imposition of tariffs.

Third Quarter 2025: Market Update

Excerpt from Westview article written in October 2025:

This note is for anyone who's been told, maybe not infrequently, that they need to look on the bright side. This year has been a test for those of us that have viewed the market’s resilience with some healthy skepticism. On a net basis, stocks have moved higher in the face of aggressive tariff policy, stubborn inflation, and a job market that is showing some signs of weakening. Investment in AI and continued growth of chipmakers have powered stocks, and their valuations, to new heights. The AI juggernaut, Nvidia, has reached not just industry-leading but market-leading size, illustrating how the fate of the two are more intertwined than ever. Still, despite this concentration risk and the S&P 500 already being up 14% through the first 9 months of the year (about 70th percentile of returns through 3Q), we see a set up for the market to end the year on solid footing.

Beyond the Obvious: How We View Investing in the AI Boom

Everyone's talking about AI. You hear about companies like NVIDIA, Microsoft, or Google leading the charge, and their stock prices have certainly reflected the excitement. But what if you're looking for those hidden opportunities, the "picks and shovels" that support the gold miners?

The largest ‘Hyperscalers’ in this space are projected to spend over $500 billion in 2026 alone and well north of $1 Trillion (yes with a T) by 2030. So where is all of this money actually going? The AI revolution isn't just about fancy software or super-smart algorithms. It’s also creating a massive demand for the less glamorous, often overlooked infrastructure that makes AI possible.

Protecting Yourself in the Digital Age

October is Cyber Security Month! In the digital age, Cybersecurity has become just as important as portfolio diversification or retirement planning. Cyber threats are constantly evolving, and individuals—not just corporations—are frequent targets. As your trusted advisor we believe it is prudent to review cybersecurity best practices and provide an update on new threats to help keep your accounts and personal data secure.

Financial fraud doesn’t always begin with stolen credit cards. Hackers often attempt to access bank accounts, investment accounts, and even tax records. While institutions, corporations, and government entities spend billions of dollars on cyber security hardware and software, the most vulnerable entry point often comes down to an individual’s personal device(s) and online practices.

Fair & Balanced Disclosure: The content of this page should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of writer as of the date of publication and are subject to change. This content herein does not constitute personalized advice from Westview or its investment professionals, or a solicitation to execute specific securities transactions. Westview is not a law or accounting firm and does not intend for any content to be construed as legal, accounting, or tax advice. Readers should not use any of this content as the sole basis for any investment, financial planning, tax, legal, or other decisions. Rather, visitors should consult their other professional advisers (including their lawyers and accountants) and consider independent due diligence before implementing any of the options directly or indirectly referenced. Past performance does not guarantee future results. All investment strategies have the potential for profit or loss, and different investments and types of investments involve varying degrees of risk. There can be no assurance that the future performance of any specific investment or investment strategy, including those undertaken or recommended by Westview, will be profitable or equal any historical performance level.

Posted in May 2023, this article guides you through SECURE Act 2.0 and how it stands to impact retirement.